GenSeneca

Well-Known Member

So what happens when raising taxes actually causes revenues from that tax to drop? What then?increasing taxes for the wealthy

Charlie Rose: "Bill Clinton in 1997 signed legislation dropping the Capital Gains rate from 28 to 20%, and George W. Bush further lowered it to 15%. In each case, lowering the rate actually increased revenues from the tax. In the 1980's, when the tax was increased to 28%, the revenues actually went down. So why raise it at all?"

Obama: "Charlie, what I've said is that I'd look at raising the capital gains tax for purposes of fairness."

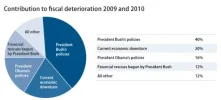

The empirical data shows that raising CG rates will cause a reduction in revenue from the tax, so I ask again... What comes of your "balanced" approach when hiking taxes actually causes us to run higher deficits due to reduced revenue? Will you reconsider your position on taxing the wealthy?Also, the CBO scored Obama's proposed tax increases and, assuming he actually gets the additional revenue from the tax hikes he's proposing (despite the historical empirical data that shows revenues will actually drop), it would presumably generate an additional $800 billion over 10 years, that's $80 billion a year - Current Deficit is $1.2 Trillion minus $80 billion = $1.12 Trillion deficit.

How much is he proposing to cut from spending? I've yet to see him put forward a single quantifiable example of where he would cut spending. As for corporate welfare, he's going to expand that, he promised to do so... He didn't call it corporate welfare though, he called it, "investments in renewable energy". Make no mistake, he will shower "green" companies with billions of taxpayer dollars and continue to bailout any company deemed "too big to fail".

His "balanced" approach doesn't even qualify as smoke and mirrors, it's shear lunacy that anyone could buy into it. If Obama really wanted to eliminate waste, fraud, and abuse from the budget, he'd resign.