Twenty of the nation's largest financial institutions owned a combined total of $2.3 trillion in mortgages as of June 30. They owned another $1.2 trillion of mortgage-backed securities. And they reported selling another $1.2 trillion in mortgage-related investments on which they retained hundreds of billions of dollars in potential liability, according to filings the firms made with regulatory agencies. The numbers do not include investments derived from mortgages in more complicated ways, such as collateralized debt obligations.

These three categories of mortgage-related financial instruments add up to a $4.7 trillion obligation for the twenty largest financial institutions. This is nearly seven times as large as the initial Paulson/Bernanke bailout plan of $700 billion, which means the plan is destined to be ineffectual.

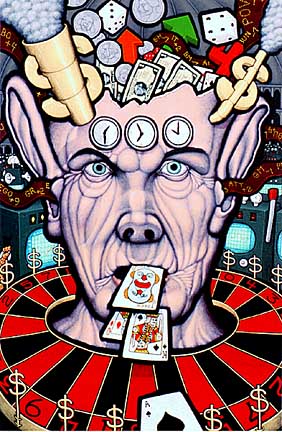

Dig deeper into the Housing Sub-Prime loan scam and you may just find some lovely "Weapons of Mass Destruction" hidden there, that Paulson & Bernanke forgot to tell the World about. Be careful of these high profile Gamblers who are there only to Loot your Money.

Be Very Careful !!!

These three categories of mortgage-related financial instruments add up to a $4.7 trillion obligation for the twenty largest financial institutions. This is nearly seven times as large as the initial Paulson/Bernanke bailout plan of $700 billion, which means the plan is destined to be ineffectual.

Dig deeper into the Housing Sub-Prime loan scam and you may just find some lovely "Weapons of Mass Destruction" hidden there, that Paulson & Bernanke forgot to tell the World about. Be careful of these high profile Gamblers who are there only to Loot your Money.

Be Very Careful !!!